Estate Planning 101

WED / FEB

18

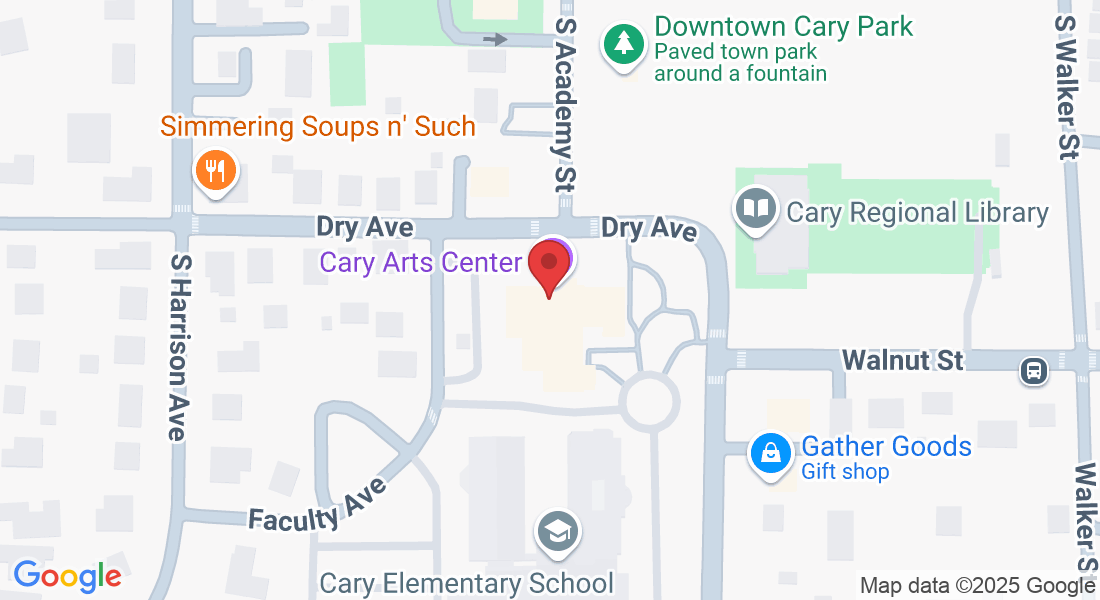

Cary Arts Center

Principal's Hall

101 Dry Ave

Cary, NC 27511

6:30 PM

Presented by Jesse Bradin

In uncertain times, it’s more important than ever to protect your estate by avoiding common and expensive mistakes. This lively, free workshop will cover planning for your family’s future, passing on a legacy, avoiding common mistakes made.

Did you know?

64% of Americans say having a will is important, fewer than 32% have one.

Only 43% of those age 55 or older have a will or living trust.

43% of U.S. adults blame procrastination as the most common barrier to estate planning.

FREE Healthcare & Financial Power of Attorney for all attendees

Please join us for this complimentary educational workshop at Cary Art Center. These important topics will be addressed:

How Estate Planning is a KEY part of a total retirement plan.

How to reduce or eliminate many forms of taxation

How can I create Tax-Free Income at retirement?

How can I reduce Estate Taxes and leave more money to my loved ones?

Who gets your home, who inherits all of your bank accounts, who will get your assets?

Who decides your healthcare or end-of-life decisions?

Jesse Bradin

J Bradin Financial LLC

(910) 448-2884

Meet Jesse Bradin – Your Trusted Guide in Estate & Retirement Planning

Jesse Bradin is more than just a fiduciary investment advisor—he’s a dedicated husband, father, and financial professional committed to helping families protect their wealth and secure their future. With a passion for putting his clients’ best interests first, Jesse offers expert guidance, personalized strategies, and unwavering support to ensure your financial legacy is protected.

At J Bradin Financial, we combine the expertise of CFPs, private asset managers, and a dedicated support team to provide tailored enhanced planning solutions that fit your unique needs. Our approach blends the resources of a large firm with the individualized attention of a boutique planning firm, ensuring that you receive the best strategies to minimize taxes, protect assets, and pass on your wealth efficiently.

Jesse Bradin

J Bradin Financial LLC

(910) 448-2884

Contact:

1155 Kildaire Farm Rd

Suite 216

Cary, NC 27511

(910) 448-2884

By submitting your registration, you agree to our Privacy Policy.

P.2025.11.01